Press Release

KOMPAS: Monitoring of Government Promises (2024-2028)

Finance Think, in partnership with the Macedonian Center for Civic Education, the Macedonian Medical Association, and the Youth Educational Forum, presents the upgraded monitoring framework KOMPAS for systematic tracking of the implementation of government promises for the period 2024–2028. This framework builds upon the previous version that mapped economic progress during the period 2020–2024.

The KOMPAS platform (https://kompas.financethink.mk) tracks the implementation of a total of 139 promises, distributed across five priority areas: socio-economy, education, health, youth, and gender equality.

Overall progress: Moderate fulfillment with significant differences across sectors

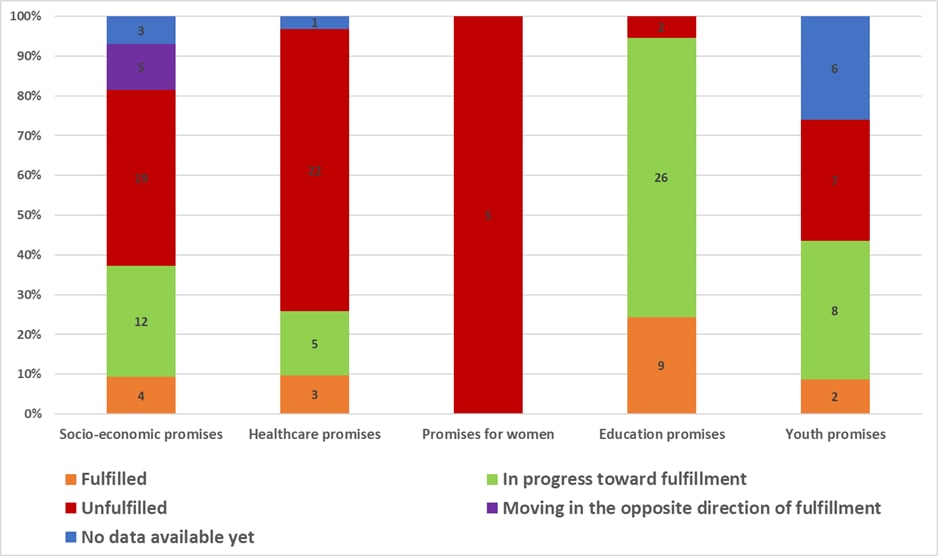

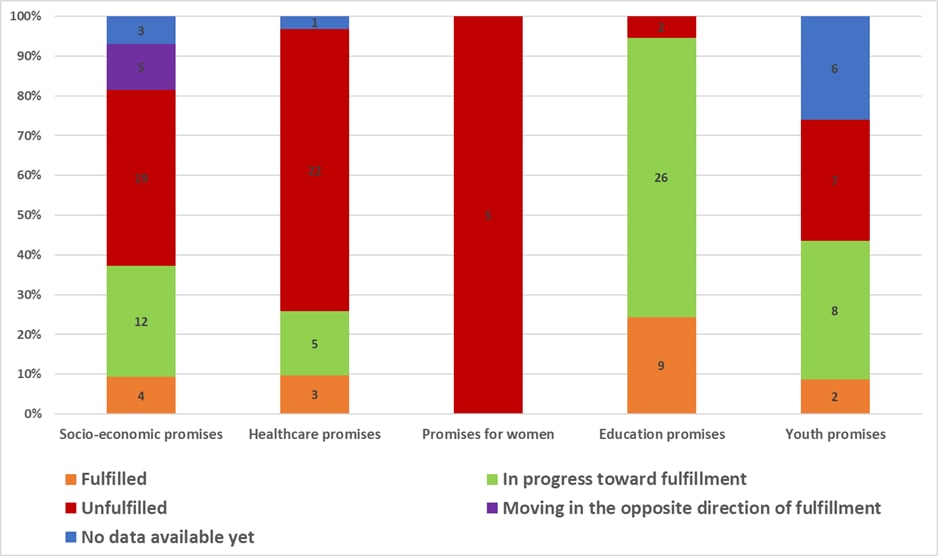

Of all the promises, 18 (13%) have been fully fulfilled so far, while 51 (37%) are in the direction of being fulfilled. The greatest progress has been made in the field of education, where 24% of the promises have been fulfilled and 70% are in the direction of being fulfilled. Next are socio-economic policies and youth policies, each with 9% of promises fulfilled. Implementation in the health sector shows a more moderate pace, with three promises fulfilled and five in direction of being fulfilled. The least progress has been observed in the area of gender equality, where there is neither an active nor fulfilled promise (Graph 1).

Graph 1: Fulfillment by area

Socio-economic policies: Partial progress, but with potential risks

Out of 43 mapped promises, 4 have been fulfilled and 12 are in direction of fulfillment. The fulfilled ones include: unchanged personal income and profit tax rates, non-taxed reinvested profits, and an increase in pensions by 5,000 denars. Those in direction of fulfillment mostly relate to stable finances contributing to macroeconomic stability such as GDP growth, inflation control, reduction of public debt and unemployment, increased investments, and new job creation.

From a fulfillment perspective, although the number of fully met promises is relatively small, the ones in direction of fulfillment are satisfactory. A greater cause for concern are the promises whose fulfillment is moving in the opposite direction, particularly as they represent key structural reforms. These include promises related to reducing the budget deficit below 3% of GDP, decreasing the grey economy, increasing productivity, supporting exports, and moderate wage growth in the public sector.

An additional challenge lies in aligning government priorities with the real needs and expectations of citizens. According to the latest research “What is key to improving quality of life?”, citizens identify that care services for the elderly and children (nursing homes and kindergartens) are considered insufficiently accessible and often expensive. Meanwhile, the quality of road infrastructure and public transport is rated the poorest. At the same time, the greatest support is given to promises for creating new jobs, capital investments, and expanding childcare capacities. On the other hand, support for increasing wages in public administration is low, with a high percentage expressing negative views, and the 16.8% increase in 2024 even exceeds the promised increase tied to economic growth.

In the upcoming period, it is necessary to maintain focus on the promises in direction of fulfillment, to complete them within a reasonable timeframe. Special attention should be given to promises that started positively by the end of 2024 but show risk of deviation in Q1 2025—such as inflation rate and stronger revenue collection in the state budget—as well as better alignment of government priorities with citizens’ expectations and real needs.

Education: Highest degree of implementation

Of 37 mapped promises, 9 have been fulfilled and 26 are in the direction of fulfillment, indicating strong activity dynamics. Promises that have been fulfilled or are in direction of being fulfilled include increasing the education budget (to 3.79% of GDP), revising the Basic Education Concept, support for successful schools, and expansion of educational inclusion measures. Although initial steps have been taken in higher education reform, implementation in this segment remains the weakest. Some promises, such as introducing the STEM concept and opening a teacher training center, have not yet been fulfilled. Some promises have not been transposed into the strategic documents of the Ministry of Education nor have been revised and reformulated to align with current policies, indicating the need for greater coherence between the Government Program and the system’s actual capacities. Still, the establishment of monitoring indicators is a positive step toward more efficient implementation tracking.

Health: Limited progress with important beginnings

Of 31 promises, 3 have been fulfilled and 5 are in direction of fulfillment. These include: increasing the capitation point for primary care doctors, abolishing economic director positions, and introducing nine new generic medicines to the positive list after a long time. The process of employing around 1,018 healthcare workers previously engaged under service contracts in public health institutions has begun. Although the process is ongoing, it faces some administrative challenges that are slowing it down. Procedures have also begun for employing private specialist doctors in public health. At the same time, projects are being implemented for renovating several health institutions and procuring new medical equipment for diagnostics and treatment in multiple health centers.

However, the challenges remain significant: fundamental reform of primary healthcare and other levels of the health system, regionalization of hospitals, shortage of medical staff, digital transformation, and establishing a sustainable system for long-term care. Additionally, citizen perceptions reveal significant misalignment between expectations and reality. Citizens report limited access to specialist healthcare, inadequate infrastructure quality, and high out-of-pocket costs for medicines and services. These findings suggest that health sector measures must be better aligned with citizens’ real needs, with a focus on improving accessibility, quality, and financial protection. The goal is to establish a modern, efficient, and sustainable health system with clear standards, improved infrastructure, and human resource capacity, which will meet citizens’ expectations and deliver quality healthcare at all levels.

Youth: Institutional progress, insufficient implementation of specific measures

Fifteen promises are being monitored, of which 2 have been fulfilled, 8 are in direction of fulfillment, and 5 have not been fulfilled. Although a new Ministry of Social Policy, Demography, and Youth has been established, along with a Center for Youth Research—representing significant institutional innovation—the announced specific promises, such as 250-euro vouchers for student electronic devices, a youth standard mobile app, or the “Buy a Home for Youth” project, have not yet been fulfilled.

On the other hand, initiatives have begun to renovate student dormitories and increase financial support for young farmers. These results point to the need for clear deadlines and strengthened institutional capacity. Furthermore, prioritization of measures should align with the real needs of citizens and youth, such as 80% support for improved housing conditions, 63% for the “Buy a Home for Youth” measure, and 73% for financial support to young entrepreneurs, among others.

The overall action is supported by the Government of Switzerland through Civica Mobilitas. Civica Mobilitas is a project of the Government of Switzerland, implemented by MCIC, NIRAS, and FCG. The views expressed herein do not necessarily reflect the positions of the Swiss Government, Civica Mobilitas, or the implementing organizations.